Update your browser to view this website correctly. Outdated Browser

For online banking click here.

|

Annual Disclosures |

Documents |

|---|---|

| For the year ended 31-12-2023 |

|

| For the year ended 31-12-2022 |

|

|

Quarterly Disclosures |

Documents |

|---|---|

| 2023 | |

| As at 30-09-2023 |

|

| As at 30-06-2023 |

|

| As at 31-03-2023 |

|

| 2022 | |

| As at 30-09-2022 |

|

| As at 30-06-2022 |

|

| As at 31-03-2022 |

|

| Annual Disclosures | Documents |

|---|---|

| Assessment Exercise - 2023 |

| Rs Mn | Performance for the Quarter ended 30th September | Performance for the 09 Months Ended | ||||

|---|---|---|---|---|---|---|

| 2023 | 2022 | % Change | 2023 | 2022 | % Change | |

| Net Interest Income | 22,545.9 | 21,283.6 | 5.93% | 58,472.9 | 60,710.6 | -3.69% |

| Net fee and commission income | 5,471.3 | 4,882.2 | 12.07% | 15,697.6 | 13,462.6 | 16.60% |

| Other income | 6,860.4 | 7,484.9 | -8.34% | 9,349.2 | 27,148.7 | -65.56% |

| Less: Impairment for loans and other losses | 12,816.9 | 16,951.2 | -24.39% | 25,919.3 | 51,911.5 | -50.07% |

| Net operating income | 22,060.7 | 16,699.5 | 32.10% | 57,600.4 | 49,410.4 | 16.58% |

| Operating expenses | 10,424.7 | 7,718.7 | 35.06% | 31,068.1 | 25,270.1 | 22.94% |

| Operating profit before VAT & NBT | 11,636.0 | 8,980.8 | 29.57% | 26,532.3 | 24,140.3 | 9.91% |

| Less: Financial VAT & NBT | 1,697.7 | 907.9 | 86.99% | 3,622.9 | 3,491.5 | 3.76% |

| Profit before income tax | 9,938.3 | 8,072.9 | 23.11% | 22,909.4 | 20,648.8 | 10.95% |

| Less - Income tax expense/(reversal) | 4,148.5 | 2,226.8 | 86.30% | 9,606.1 | 6,210.5 | 54.68% |

| Profit for the Period | 5,789.8 | 5,846.1 | -0.96% | 13,303.3 | 14,438.3 | -7.86% |

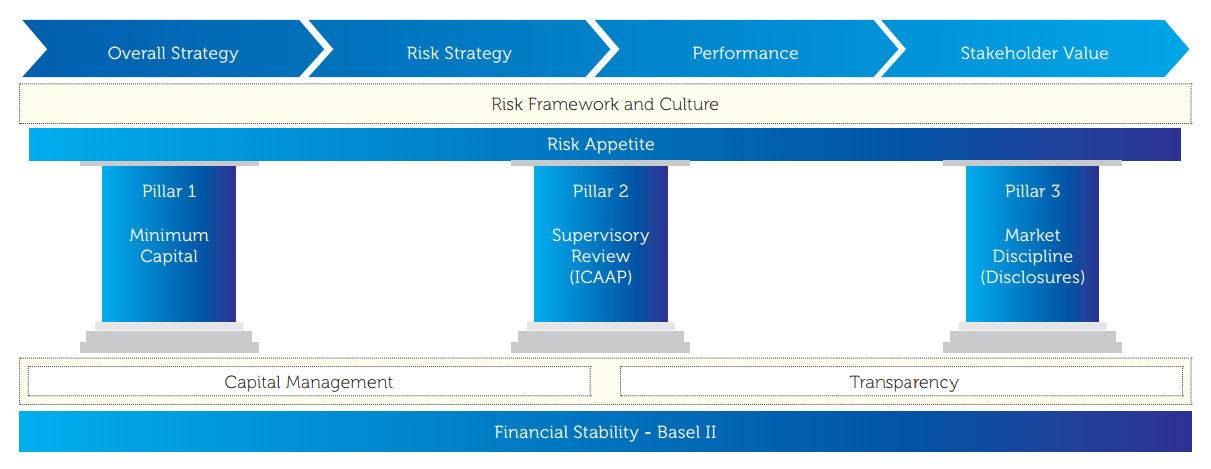

A clear understanding of risks surrounding the business activities is essential for any organisation to create sustainable stakeholder value through executing its strategies. It is therefore, essential to reinforce the overall strategy of an organisation with a prudent risk management strategy so that the opportunities could be optimised while minimising the effects of down-side risks. Banks which are responsible for the vital role of financial intermediation in the economy should be more committed to managing their risks in a prudent and transparent manner compared to a normal business organisation. Accordingly, Basel Committee on Banking Supervision has formulated broad supervisory standards and guidelines to inculcate industry best practices across the banking institutions through ‘Basel Accords’ (Basel II, the second of the Basel Accords which has been extended by Basel III). While Basel Accord encourages convergence towards common approaches and standards, the ultimate purpose of these rules is to create financial stability and resilience in financial sector institutions.

The Basel II framework is built on three Pillars and the progress made by the Bank in achieving these standards are discussed below:

| Pillar 1 |

Pillar 2 | Pillar 3 |

|

|---|---|---|---|

| Concept |

Maintenance of minimum regulatory capital for credit risk, market risk and operational risk. |

Supervisory review process to evaluate the activities and risk profile of the Bank to determine whether the Bank should hold higher level of capital than the minimum requirement in Pillar 1.This mechanism is commonly known as ICAAP (Internal Capital Adequacy Assessment Process). |

Complements the minimum capital requirement and the supervisory review process (i.e., the first and the second pillars) by developing a set of disclosure requirements to facilitate market participants to assess the risk exposures of banks and way in which the risks are managed. |

| Progress Made by the Bank | Computation of capital adequacy as per regulatory requirements. | The Bank has implemented a comprehensive ICAAP framework since December, 2013. | The Bank started providing a comprehensive set of risk management disclosures from 2012 in line with the regulatory requirements to enhance market discipline. |

In addition to meeting the requirements stated in the Risk Management Framework prescribed by the regulator, the Bank has progressed well in implementing the International Best Practices of Risk Management by acquiring risk management software systems for Credit, Market and Operational risks.

The Bank is complied with the regulatory requirements in establishing the Liquidity Coverage Ratio (LCR) and Net Stable Funding Ratio (NSFR), two prominent standards prescribed under Basel III Framework.

With the objective of achieving a more resilient banking system in the country, CBSL implemented Basel III minimum capital requirements from July 01, 2017 with specified timelines to increase minimum capital ratios to be fully implemented by January 01, 2019.The capital ratios of the Bank as at 31st December 2022 were as follows;

| Type of ratio | Group | Bank | Minimum Requirement + HLA* |

|---|---|---|---|

| Common Equity Tier 1 (CET 1) Capital Ratio | 11.341% | 11.389% | 8.50% |

| Tier I Capital Ratio | 11.341% | 11.389% | 10.00% |

| Total Capital Ratio | 14.507% | 14.657% | 14.00% |

* HLA – Higher Loss Absorbency (Requirement applicable to the Bank is 1.500%)

In line with such directive, introduction of various capital buffers and strengthening of level of capital as well as avoidance of systemic risk is expected to be achieved. The Bank is gearing to embrace changes to be proposed in line with this and work towards providing a safe banking system to our stakeholders.

Risk Management Framework More>>

Integrated Risk Management Function & Disclosures More>>

Capital Adequacy Computation More>>

If you`d like more help & information, you can: